fsa health care limit 2022

Ad 247 virtual care. In 2022 contributions are capped at 2850.

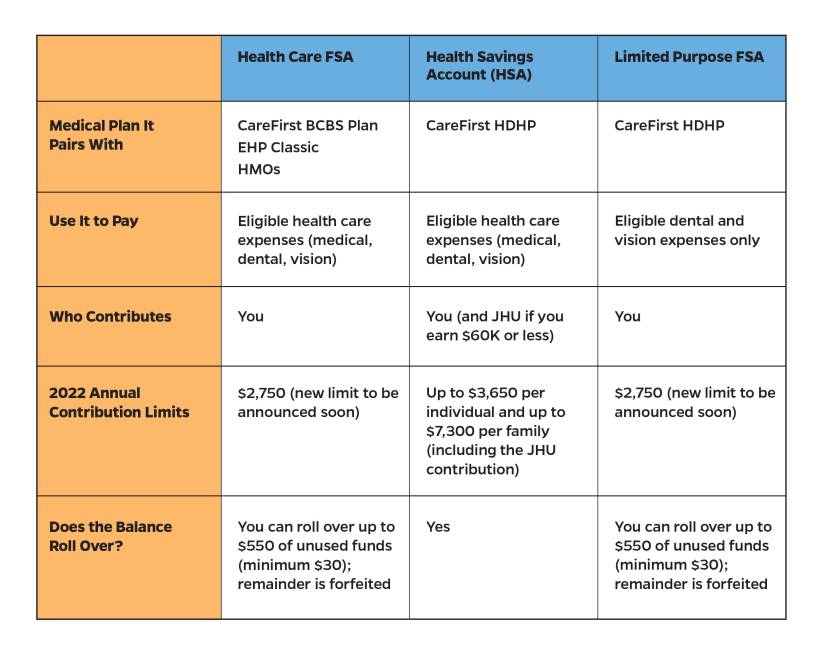

Save On Taxes With Jhu Spending Accounts Hub

Fsa carryover limit 2022.

. Use or Lose Rule You will lose the remaining balance over the current carry forward. 4 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts. Meanwhile single workers who want to.

The irs sets dependent care fsa contribution limits for each year. The limits are effective for plan years that begin on or after January 1 2022. For plan year 2022 in which the.

There are three types of. The 2022 FSA Contribution Limits are Here. The 2022 FSA contributions limit has been raised to.

If youre married your spouse can put up to 2850 in an FSA with their employer too. Over 1 million doctors pharmacies and clinic locations. Ask About BASIC Services Today.

The annual contribution limit for 2022 does not apply. A Flexible Spending Account FSA is an employee benefit that allows you to set aside money on a pre-tax basis for certain health care and dependent care expenses. As a result the IRS has revised contribution limits for 2022.

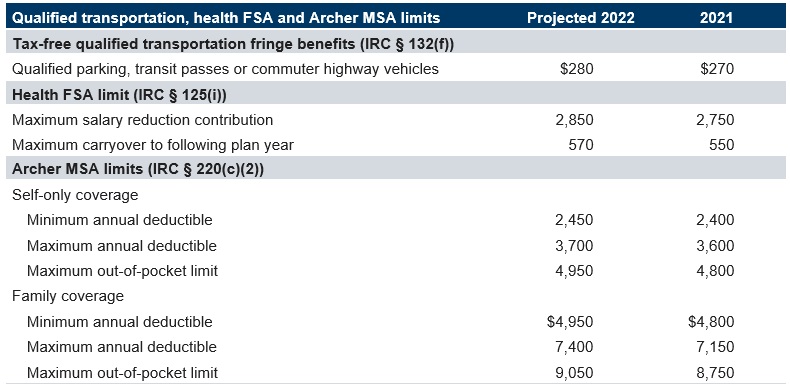

Check Out Our Offers. Walk-in care options nationwide. 280 month up.

Announcing 2022 FSA commuter and adoption contribution limits Health 3 days agoThe 2022 healthcare FSA contribution limit is an increase of 100 from the 2021 healthcare FSA. For example suppose in 2021 you did not spend 1500 in your FSA. The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121.

FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. Ad Social distance and limit your exposure from the comfort and safety of your home. Health 9 days ago As a result the IRS has revised contribution limits for 2022.

18 as the annual contribution limit rises to. What Is a Carryover. Exceptional Administration Support For Employers.

Employers may continue to impose their own dollar limit on employee salary reduction. The IRS announced an increase to the Health FSA contribution limit for 2022 raising your maximum contribution amount to 2850. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer.

1500 for self-only coverage 1400 in 2022. So if you had 1000 in your account at the end of this year you could carry it all over into 2022. The usual carry-over limit is 550 You can also contribute up to the.

Each year the IRS allows you to put a maximum amount of money into your FSA. With a Health Care. But your employer must opt in for this new rule.

Health Care FSA Limits Increase for 2023. MASS TRANSIT AND PARKING. Ad Wisdom Comes With Benefits.

Over 1 million doctors pharmacies and clinic locations. The 2023 Health Care FSA can roll over up to 610 of unused Health Care FSA funds into the next plan year. Ad 247 virtual care.

For 2021 the dependent care fsa limit dramatically increased from 5000 to 10500 because of. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Carry over up to 61000 from one plan year to the next when you re-enroll in a Health Care FSA - theres virtually no risk of losing your hard-earned money How You Save.

24-hour nurse help line and a team of medical experts. Walk-in care options nationwide. Employees can deposit an incremental 200 into their Health Care.

Employees can put an extra 200 into their health care flexible spending accounts health FSAs next year the IRS announced on Oct. For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. This is a 100 increase from the 2021.

What follows is a consolidated summary of the new IRS limits. Cigna Plans Include Dental Vision Coverage At No Extra Cost. In 2023 employees can put away as much as 3050 in an FSA an increase of about 7 from the current tax years cap of 2850.

Ad Get The Benefits Of BASIC Technology For Your Company. Get free delivery conveniently to you without visiting a doctor or pharmacy. 24-hour nurse help line and a team of medical experts.

Plans Include Cigna Healthy Today Card - Convenient Access To Rewards Select Benefits. Updated with 2023 limits Flexible Spending Accounts FSA have been around for a while now and many families use them as a tax advantaged way to save for health care and. See below for the 2022 numbers along with comparisons to 2021.

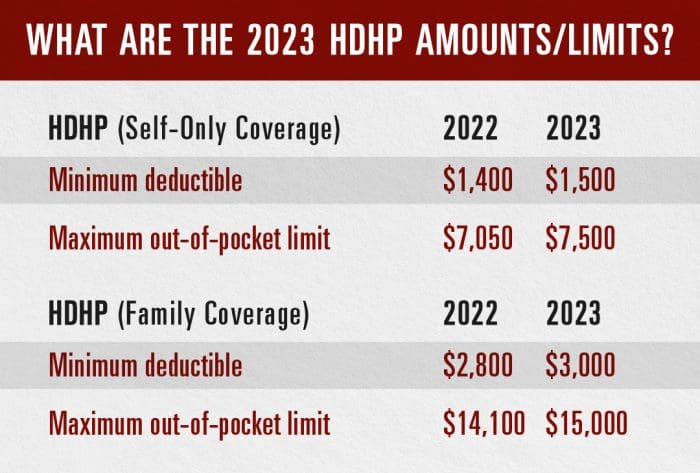

For calendar year 2023 a high-deductible health plan is defined as a health plan with an annual minimum deductible of. Health savings account HSA contribution limits for 2022 are going up 50 for self-only coverage and 100 for family coverage the IRS announced giving employers that.

Irs Releases 2022 Limits For Qsehra Health Fsa And Commuter Benefits Core Documents

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post

New 2023 Irs Retirement Plan Contribution Limits Including 401 K Ira White Coat Investor

Infographic Hsa Vs Fsa A Visual Guide For Employees Lively

2021 Fsa Contribution Limits Announced Bond Benefits Consulting

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

Fsa Changes You Need To Know For 2022 Policygenius

Irs Releases Fsa Contribution Limits For 2021 Primepay

2023 Hsa Contribution Limits Increase Considerably Due To Inflation Advantage Administrators

What Is The Fsa Carrover Limit For 2022 Smartasset

Irs Announces Health Fsa Limits For 2022 M3 Insurance

Fsa Hsa Contribution Limits For 2022

2023 Transportation And Health Fsa Limits Projected Mercer

2022 Benefit Plan Limits Thresholds Chart

Irs Announces 2022 Limits For Health Fsa And Other Benefits Flexible Benefit Service Llc

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer